How To Navigate Through Tariffs

President Trump's tariffs (and Canada's counter-tariffs) have made the headlines almost daily over the last few months. It seems like there's always a new twist. Tariffs are on, then off, then on for specific product categories, then off, etc.

The result is a lot of uncertainty.

And financial markets hate uncertainty.

As I write this, the S&P500 and Nasdaq Composite indices are down 4.3% and 9.5% year-to-date, respectively. In Canada, the S&P/TSX Composite index is off 5.8% from its January peak. The Canadian dollar is also under pressure, reaching a multi-year low of $0.68 against the USD last month.

During such a period of volatility, I'm sure the question on everyone's mind is: What should I do?

Is this a minor pullback or the start of a prolonged bear market?

It's hard to believe that Trump intends to tank the stock market and make everyone poorer on paper, on top of an expected resurgence in inflation due to tariffs. That said, I'm puzzled as to what his intentions really are.

As in poker, we'll have to make educated guesses with imperfect information here.

Here's my take on the situation and how I'm thinking about the optimal way to position a portfolio currently. Please remember that this is not investment advice, as your situation may differ from mine. My goal is to help you think about your portfolio and how to adjust it if necessary.

Let's start!

What I'm Avoiding or Reducing

Companies selling products to the US. At the risk of stating the obvious, companies that ship products across the border to the US should be affected by tariffs unless their product is highly differentiated with a moat. One example where I think risk is mitigated is Microbix Biosystems (TSX: MBX), which sells regulated medical devices to US customers. There aren't many readily available alternatives for some of their SKUs, and the switching costs would be high for customers. On the other hand, companies selling commodities or undifferentiated products with many US-made alternatives appear riskier here.

Companies that are cyclical or sensitive to the economy. Depending on how far Trump takes this trade war, there's a risk it might tip the US and/or other countries into recessions. Anything that's tied to the health of the economy could suffer. Examples could be companies selling highly discretionary consumer goods or AdTech companies that depend on advertising budgets from large corporations.

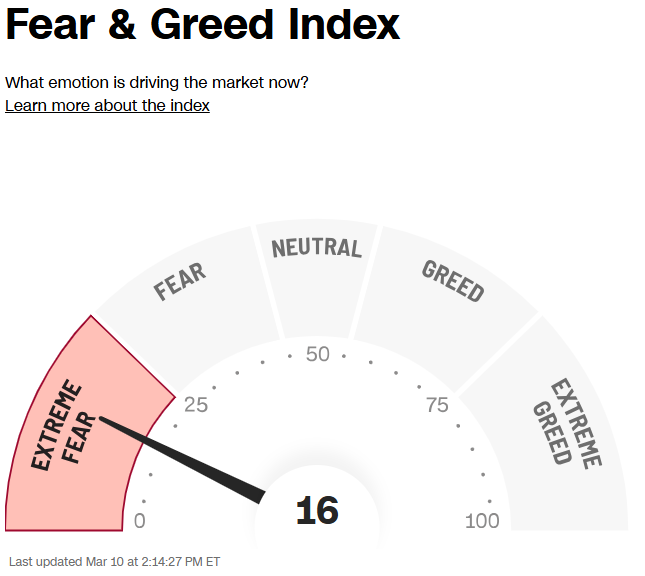

Companies that need to raise capital. As you can see below, the market is in extreme fear territory. If the market environment deteriorates further, the financing activity will likely dry up again, like we've seen in microcaps during 2022-2023. I would favour companies with strong balance sheets and no refinancing risk at the moment.

What I'm Keeping or Adding To

US companies selling in the US. There are a few instances of Canadian-listed companies that are domiciled in the US and predominantly sell into the US market. These companies could benefit from protectionist measures and not be impacted by them. If a baby gets thrown out with the bath water, it could present a good entry point. One example I'm watching is California Nanotechnologies (TSX-V: CNO), a California-based company that derives most of its revenues from US customers despite its Canadian stock listing.

Canadian companies selling in Canada. Canadian companies selling domestically should do well if protectionist measures are enabled on both sides of the border. The main risk would obviously be a recession in Canada. For this reason, I favour domestic industries that should be recession-resistant, such as healthcare, infrastructure, and non-discretionary consumer goods. An example would be BioSyent (TSX-V: RX), which sells critical healthcare products in the Canadian market.

Technology companies. Software-as-a-Service (SaaS) companies seem reasonably insulated from the global trade war, whether they sell in the US, Canada, or abroad. I've always had a high technology allocation in my portfolio, and this is an area that I haven't changed much lately. I tend to prefer B2B software companies that are mission-critical to their customers because they should keep high customer retention rates even through downturns. A good example of a company I’m watching is Kneat.com (TSX: KSI).

Cash. Although I'm not a big fan of timing the market, there are times when being more defensive is appropriate. I like Howard Marks' approach in that regard. His thought experiment is to travel into the future, look back at today, and ask himself if he wished he'd been more aggressive or defensive back then. "What you think you might say a few years down the road can help you figure out what you should do today." When I perform this exercise and think about all the global uncertainty, on top of elevated large-cap valuations, I feel like I should err on the side of caution. Defensive can mean holding a bit more cash than usual. It can also mean holding stocks with stronger downside protection and shedding some of the more speculative assets (i.e. unprofitable high-growth companies, cryptocurrency-related companies, story stocks, etc.)

In a perfect world, we could all rebalance our portfolios right away without any market impact and at the valuations we want. Unfortunately, the reality is far more nuanced. There are transaction costs, tax implications, and liquidity issues.

The market could rebound next week and go on to make new highs, or it could go down another 30%. Trump might implement long-term tariffs and significantly hurt the Canadian economy for years to come, or he could back off and revert to a friendly stance.

In times of uncertainty, it's crucial to think in probabilities. How will my portfolio fare if X happens? What if Y happens? What about Z?

Suppose you assign probabilities to different scenarios and weigh your portfolio positions based on the probable outcomes. Hopefully, you'll win most of the time and won't lose too much the rest of the time.

That’s why we own portfolios of stocks with different risk and reward profiles instead of a single stock.

We have to make educated guesses and surrender the outcome.

Just like a good poker player!

Disclaimer

This publication is for informational purposes only. Nothing produced under the Stocks & Stones brand should be construed as investment advice or recommendations. Mathieu Martin, the author, is employed as a Portfolio Manager with Rivemont Investments. This publication only represents Mathieu Martin’s own opinions and not those of Rivemont. Rivemont may own positions and transact on any securities mentioned in this publication at any time without prior notice. At the time of this writing, the Rivemont MicroCap Fund holds shares of Microbix Biosystems (TSX: MBX) and BioSyent (TSX-V: RX). Always do your own research and consult a professional before making investment decisions.

If you’d like to invest in small public companies, check out this post.

Have you ever looked at Sylogist? A very nice entry point right now if you ask me.

FYI, Canada has a lot of support among Amricans. (i lived there a few years myself).

brookfield's mark carney is leaving to become Canada's next PM and deal with trump. carney also has experience as Bank Governor for 2 nations ; this is bringing a bazooka to a pillow fight.

on top of that, the Canadian people seem pretty tired of all MAGA\musk agendas. they seem willing to take the pain of keeping their tariffs in place for some time until flops stop and someone (else) is leading serious negotiations and not pimping propaganda.

but hey, at least there is trumpcoin for american retirement, and~40 fewer lbs of northern fentanyl.