It's been five months since I wrote Flurry of Acquisitions, my most popular post to date. Back then, I provided a recap of four recent Canadian microcap acquisitions and made a forecast that turned out to be spot on:

You don't have to take my word when I say Canadian smallcaps are extremely undervalued. But you can't ignore the facts. US capital is coming, and it's coming in a big way. I don't think we've seen the end of it.

The S&P/TSX SmallCap Index bottomed six days later (after an almost nine-month decline) and rebounded 13% since. Some beaten-down, high-quality stocks have performed much better.

And on top of that, we've seen several more acquisitions.

If you want to read my thoughts on previous acquisitions and the dynamics in the private equity market that created this perfect storm, I recommend reading my earlier posts: Private Equity is Coming and Missing Out.

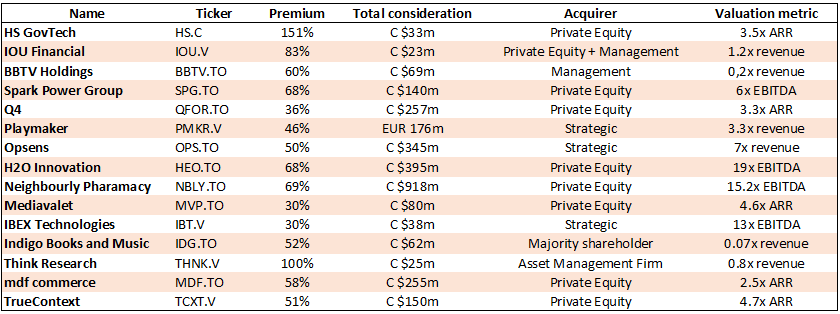

Instead of going into specific details about recent transactions, here's a recap of the announcements in the last nine months or so:

Besides valuations, some of the crucial metrics to me are the following:

The average premium offered was 63%, with a low of 30% and a high of 151%.

A private equity firm was the buyer in 9 out of 15 transactions.

The average transaction value was $203 million, with a low of $23 million and a high of $918 million (I set the cut-off at $1 billion for this list).

I'm also quite interested in the subset of technology companies on this list, as they were all acquired by private equity firms.

As you would expect, there is a strong correlation between growth rate and valuation. The average growth rate was 12%, and the average valuation was 3.7x Annual Recurring Revenues (ARR), similar to the median transaction (HS GovTech).

Another interesting data point is the percentage of revenues generated in the US, which was very high in all cases (75% on average). I believe that's part of why US private equity firms, in particular, have been all over these types of opportunities.

What To Look For

‘‘Who’s next?’’ you ask.

Well, if you're a Canadian tech company growing at least moderately (10-15% or more) and trading at less than 3x ARR, you have a big target on your back. Bonus points if 60%+ of your revenues come from the US.

Then, other metrics will reveal some hints about the quality of the revenues, like gross margin percentage, net revenue retention rate, customer concentration, etc. Higher-quality, stickier revenues will be worth a higher premium.

I've compiled a list of 10 ideas in the Canadian tech sector that I think will likely be acquisition candidates. I'm not recommending any of those (read the disclaimer below). Based on the abovementioned criteria, I just think they would make sense as acquisition candidates.

I've highlighted the three best scores on each metric (column) in darker orange. A few companies stand out and rank well on several metrics. For example, Givex and Wishpond are some of the cheapest, with relatively decent growth. Sangoma Technologies also looks attractive based on its low valuation and the high proportion of revenues coming from the US.

When you compare these metrics with the recent transactions, it's obvious that there are several opportunities here. While I'm not making any recommendations, I hope this analysis can be helpful as an idea-generation tool and a starting point for further research.

Do any of them stand out to you?

Which company did I miss?

Share your thoughts in the comments!

You can also follow me on X (Twitter) and LinkedIn, where I post all new transactions as they happen.

Disclaimer

This publication is for informational purposes only. Nothing produced under the Stocks & Stones brand should be construed as investment advice or recommendations. Mathieu Martin, the author, is employed as a Portfolio Manager with Rivemont Investments. This publication only represents Mathieu Martin’s own opinions and not those of Rivemont. Rivemont may own positions and transact on any securities mentioned in this publication at any time without prior notice. At the time of this writing, the Rivemont MicroCap Fund holds positions in Renoworks Software (TSX-V: RW) and Ackroo (TSX-V: AKR). Please also note that the Rivemont MicroCap Fund owns 14.9% of Ackroo’s shares and is considered an insider of the company. Always do your own research and consult a professional before making investment decisions.

If you’d like to invest in small public companies, check out this post.

Maybe Pluribus Technologies Corp PLRB.V which is currently undergoing a strategic review. Company has 70% of recurring revenue and trades at ~0.07x Sales and ~0.65 EV/Revenue

AirIQ (IQ.V) would be a good addition to your list.